Last Updated on July 12, 2023

The VIX is the abbreviation for the Volatility Index offered by the Chicago Board Options Exchange (CBOE). It is often referred to as the Fear Index by traders. Though this name may be daunting, it is a little misleading. The ability for the VIX to predict large price drops is why it is associated with fear, but in reality trading fear is only half of the story. You could also use the VIX to trade volatility long, which wouldn’t mean banking on fear but strong optimism.

The concept of this kind of index first came from a paper in 1989 and it was introduced to the markets from the CBOE in 1993. The CBOE website defines the VIX like this:

“The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPXSM) call and put options. On a global basis, it is one of the most recognized measures of volatility — widely reported by financial media and closely followed by a variety of market participants as a daily market indicator.”

Call and put options are the numerical basis for the VIX. The reasoning behind using call and put options is very sensible. Calls are taken by traders when they think the price of the asset will rise, and puts are taken when there is an expectation the price will fall. Applying this method to the S&P 500 makes call and put option trading a good barometer for market volatility. The S&P is used because it is a good approximation of how the whole economy is doing.

The VIX allows you to speculate that there will be more or less volatility in the future. As was noted, put and call options are the statistic driving this model of volatility, with puts being the indicator of volatile downward S&P price movement. One could potentially take a long position on VIX futures assuming that volatility will increase, or a short position assuming it will decrease. Similarly to any other future contract, profits are made after closing the position if the VIX moved the direction of your position, and you will lose money if it moved against your position. In these contracts 0.05 is the minimum tick size with a $1000 multiplier, meaning each tick of price movement represents $50 of profit or loss.

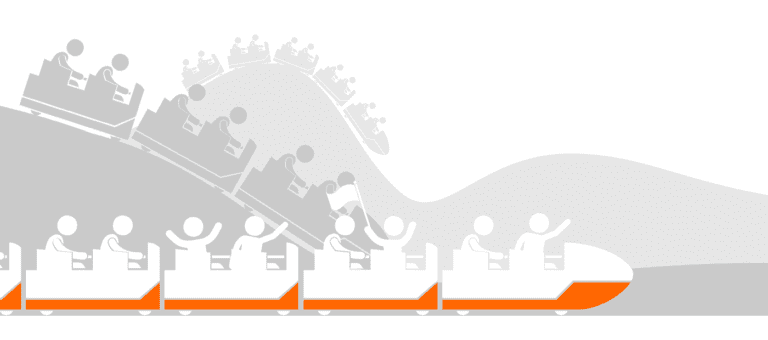

The upward volatility aspect is often ignored for a few reasons. Crashes may be rare but they are obvious, dramatic, and most of all painful, so people remember them clearly. In contrast, the market gaining enormously is not something that garners the same historical notoriety. It’s somewhat common for people to know about the crashes in 1929 and 1987, but it would be a safe bet that far less people would know about the days with the biggest S&P gains in history. The lives of more people are directly affected by the crashes, making them legendarily bad moments. The VIX gives clear signals about volatility and could let you hedge your bets.

Let’s take a look at the numbers. The VIX is measured in points, representing the underlying volatility percentage. Currently the VIX is at a rather low 15 points with a long term average around 19. However, when examining the VIX, the recent past data should be taken into consideration because it’s more about relative changes than absolute ones. More explicitly, a 15 point VIX means that the price of the S&P 500 will be within plus or minus 15% at the end of the period. This is within one standard deviation of confidence, meaning that it should be correct 68% of the time.

Speaking of points, the VIX reaches its biggest point levels when the market is crashing. October 24th 2008 found the VIX rising to 89. This was due to the subprime bubble, and it indicated that prices were set to change wildly. One of the largest spikes of the VIX you will find occurred around the market crash in 1987. Though the VIX was not traded at that time, you can use it with the data to give the point value output. When the VIX formula is applied to the 1987 crash, it outputs a dizzying 150 points. This shows how the VIX can act like the canary in the coal mine, warning traders of the greatest dangers.

The VIX peaked on Feb 4 at 29.06 points, the highest point in the last 3 years. Since then it has fallen in a few waves, going under 20 points on 8th April. The most recent week of VIX saw an increase around half a point to 13.17, the first upward movement in around 6 weeks.