Last Updated on August 14, 2024

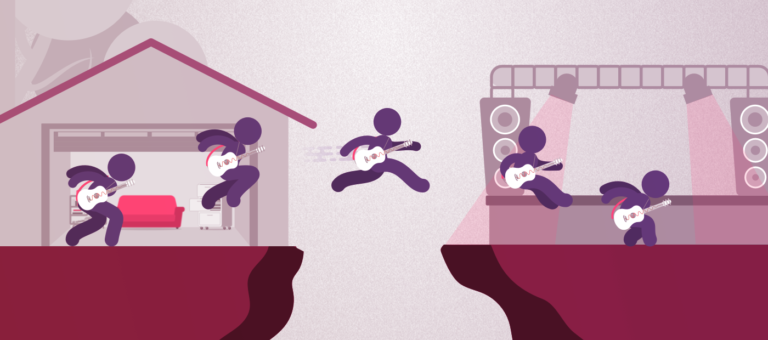

Do you know what some of the most prominent musicians or world-famous bands, like U2, the Beatles, or Ed Sheeran, have in common? They all started small – rehearsing in the kitchen or a garage. Then they made the biggest and most decisive step – getting out in the wild, performing on the streets and in local bars in front of small crowds. Slowly after, the crowds got bigger, the bars became stadiums, the national tours became international, and all these great musicians began writing history.

In the trading world, the leap from a demo to a live, funded trading account is akin to an aspiring musician transitioning from practicing in their garage to performing on the world stage. While the fundamentals of playing the instrument remain the same, the stakes, the pressure, and the environment shift dramatically. This transition requires not just technical skills but also psychological resilience and strategic preparation. In this article, we will nail down the strategies that you need to master to successfully navigate the transition, as well as identify and overcome the most common pitfalls on your way to making it as a pro trader.

5 Strategies to Help You Seamlessly Transition From a Demo to a Funded Trading Account

The journey from a demo to a funded trading account can often be challenging due to the increased emotional pressure, the need for rigorous discipline, and the complexity of trading with real money. Many traders find themselves overwhelmed, leading to mistakes that could have been avoided with proper preparation and strategy.

Mastering the transition requires a holistic approach that addresses both the psychological and technical aspects of trading and mitigate risks on the path to long-term success.

- Acknowledge the Psychological Shift

The first and perhaps most significant challenge in moving from a demo to a live trading account is overcoming the psychological barrier that losses are no longer on paper. Now, they can affect both your confidence and your wallet, making the experience inherently more stressful.

Think about this in the sense of a tightrope walker. Walking a tightrope a few feet off the ground is daunting but manageable if you practice enough. However, walking the same rope strung between two mountain tops is a whole other thing. Even though the skill required is identical, the stress and the fear of falling change everything.

Similarly, trading with real money introduces fear of loss, which can cloud judgment and lead to irrational decisions. Rosa, one of Earn2Trade’s graduates, who has been trading since July 2021, shares that she finds the psychological side of trading the most challenging one. She notes that when emotions prevail over rational thinking, you might miss an opportunity, and trying to fix a mistake driven by emotions can make you lose even more, no matter how good your strategy is. To overcome this, she has learned not to overtrade and become better at controlling her mind.

- Build a Robust Trading Plan and Stick to It

Creating a well-structured trading plan is the most effective measure in counteracting psychological pressure. The plan should cover the following key points:

- Risk Management: Define the maximum capital you are willing to risk on a single trade. A common rule is to risk no more than 1 – 2% of your trading capital on any single trade.

- Entry and Exit Strategies: Determine the conditions under which you will enter and exit trades based on technical indicators, fundamental analysis, or a combination of both.

- Position Sizing: Decide on the size of each trade based on your total capital and risk tolerance. Proper position sizing helps manage risk and avoid significant losses.

- Record Keeping: Maintain a trading journal to document every trade. This should include the reasons for entering and exiting the trade, as well as reflections on the outcome to help identify patterns in your trading behavior and improve future performance.

- Review and Adaptation: Regularly review your trading plan and adapt it based on your performance and changing market conditions. Famed trader Jesse Livermore said:

A speculator must not merely be a student; he must be a student of himself.”

Equally important to having a trading plan is sticking to it. Deviating from your plan can lead to emotional trading, which often accumulates significant losses. Without a plan, traders are more likely to react impulsively to market fluctuations, increasing the risk of making poor decisions. Ignoring your plan can also lead to overtrading and, ultimately, capital loss.

By sticking to a well-defined plan, traders can mitigate these risks and enhance their chances of achieving sustained profitability.

As Warren Buffett puts it,

An idiot with a plan can beat a genius without a plan.”

- The Transition Is a Marathon, Not a Sprint

One effective strategy to ease the transition is gradually moving from a demo to a live account. Start by trading with a small amount of real money while continuing to trade in the demo account. This hybrid approach allows you to acclimate to the emotional aspects of live trading without putting significant capital at risk.

The best strategy for succeeding in this is following the pilots’ approach. Pilots spend extensive time in flight simulators before taking control of an actual aircraft. Even after they start flying, they do so under the supervision of experienced pilots. Similarly, transitioning traders can benefit from gradually increasing their exposure to real-money trades while still relying on the “simulator” of the demo account for practice and confidence building.

- Leverage Technology to Ease Your Transition

In the digital age, traders have access to many tools and technologies designed to assist in the transition from demo to live trading. These tools can help manage risk, analyze market conditions, and automate trading strategies.

For example, you can utilize advanced trading platforms with extensive capabilities, such as Finamark and NinjaTrader, to ensure access to top-notch features.

You can also capitalize on platforms like Journalytix to ensure access to a real-time “trader assistant” packed with features like audio news, economic releases, risk and position monitoring, P&L charting, and more to help you seamlessly get through your trading day.

Laura, a lawyer by day and a trader by night, for example, has found Earn2Trade’s trading platform very intuitive and capable, allowing her to easily track her progress, analyze and learn from her mistakes, and build a steady trading plan she can trust.

Taking advantage of risk management software is also crucial for ensuring a seamless transition since it helps you manage your exposure and stick to your risk strategy. More advanced traders can also employ automated trading systems to execute trades based on predefined criteria to remove emotional components from their decision-making.

Last but not least, it is essential to use backtesting software to help you validate your trading strategies based on historical data before implementing them in a live account.

- Embark on a Journey of Continuous Learning and Adaptation

The transition to live trading is not a one-time event but an ongoing process. Markets are dynamic, and to be successful, one should continuously learn and adapt their strategies. Useful in that regard is engaging with trading communities, attending webinars, and reading industry-specific literature to keep abreast of new strategies and market-moving dynamics.

The most successful traders perceive themselves as lifelong students who are always on the hunt for new information. Just as a doctor or lawyer must continually improve their knowledge and skills, so must a trader. The market is your ever-evolving textbook, and staying informed is critical to long-term success.

How to Avoid the 10 Most Common Mistakes During the Transition From a Demo to a Live Funded Trading Account

It is worth noting that even if you have the most robust strategy and stick to it, the transition from a demo to a live trading account might still present you with unexpected challenges. Let’s explore some of the most common pitfalls that might await you around the corner and see how to best prepare for them.

Pitfall 1: Overconfidence

Traders who pass their evaluation programs successfully and achieve a series of winning trades in a demo account can often become overconfident. However, the market conditions and the psychological factors involved are different when real money is at stake, and overconfidence can quickly turn into disappointment.

Solution: Start small and scale up as you gain experience and confidence in live trading. Stay humble and stick with a cautious trading approach. Treat every winning trade as a small step, so you can keep your feet on the ground and not get carried away.

Pitfall 2: Inadequate Risk Management

This principle applies to all trading activities, be it swing, day, or else. Many traders that fail do so due to chasing huge profits in a small number of trades (e.g., they adopt more risk and are more leveraged). However, this strategy isn’t sustainable and can wipe out your portfolio even if the market goes against you for just one or two trades.

Solution: Stick rigidly to your risk management strategy. Use stop-loss orders to limit potential losses. Regularly review and adjust your risk parameters based on market conditions and performance.

Pitfall 3: Emotional Trading

Allowing emotions to drive trading decisions can result in impulsive and irrational trades. The risk of emotional trading is usually the highest right after a losing trade when traders try to overcompensate and end up chasing riskier opportunities that aren’t aligned with their risk management plan. The renowned market guru Paul Tudor Jones says:

The most important rule of trading is to play great defense, not great offense. Every day I assume every position I have is wrong.”

Solution: Develop a disciplined approach to trading. Use automated systems if necessary to remove the emotional component. Practice mindfulness and stress-reduction techniques to maintain a clear and focused mind.

Luis, a pharmacist from New Jersey and an active Earn2Trade trader, shares that his trading strategy includes a predefined daily loss limit and targeted profit. He believes the key to success is following it strictly, being calm when evaluating the market, and never getting carried away with emotions.

Pitfall 4: Lack of a Trading Plan

Entering trades without a clear plan can lead to inconsistent results and unnecessary risks. Doing so will mean throwing things at the wall, hoping some will stick. Even if they do, it will be due to pure luck, which won’t get you far in trading. In the words of Bruce Kovner:

My experience is that as soon as people start to chase performance, they begin to lose discipline.”

Solution: Develop a comprehensive trading plan before transitioning to a live account. Include detailed strategies for entry and exit, risk management, and position sizing. Review and update your plan regularly.

Pitfall 5: Chasing Losses

Attempting to recover losses by making larger, riskier trades can cost you your entire account balance in just a few moves. Many traders have learned this the hard way so that you don’t have to.

Solution: Accept losses as part of trading and stick to your risk management rules. Focus on making consistent, well-thought-out trades rather than trying to recover losses quickly. The losses are compensated for not through a big win but many small ones.

Pitfall 6: Ignoring Market Conditions

When it comes to trading, there are numerous variables at play, many of which will be outside your control. In addition, markets evolve all the time, meaning that you should anticipate that change and adjust accordingly. Failing to adapt your strategies to changing market conditions can lead to poor performance or even take you out.

Solution: Stay informed about market trends and economic indicators. Be flexible and willing to adjust your strategies based on current market conditions.

Pitfall 7: Neglecting Psychological Preparation

Have you ever wondered why there are so many books on trading psychology? The reason is that this is one of the most challenging aspects of trading to master. The emotional burden of trading is heavy, and many people can struggle handling it. In that sense, underestimating the psychological challenges of live trading can accumulate increased stress and lead to poor decision-making.

Solution: Prepare mentally for the transition by understanding the psychological differences between demo and live trading. Consider working with a trading coach or psychologist to develop mental resilience.

Pitfall 8: Overtrading

Making too many trades can increase transaction costs and reduce overall profitability. That’s why the world’s best traders all have one thing in common – they don’t always rush to trade. According to Warren Buffett, the stock market is designed to transfer money from the active to the patient. The world-renowned trader Bill Lipschutz said:

If most traders would learn to sit on their hands 50% of the time, they would make a lot more money.”

Solution: Focus on quality over quantity. Develop a strategy that identifies high-probability trading opportunities and stick to it.

Pitfall 9: Inconsistent Review and Adaptation

Just as the best sports teams spend hours in post-game analysis to improve for the next game, so should you as a trader. This is the best way to learn from your mistakes and ensure that you won’t repeat them in the future. On the other hand, failing to review your trades and adapt your strategies regularly can be among the most significant roadblocks toward your progress.

Solution: Maintain a trading journal and review it regularly. Reflect on your trades, identify patterns, and adjust your strategies as needed.

Pitfall 10: Ignoring Feedback

In the trading game, there is always someone better, more experienced, and more knowledgeable. If you are lucky to befriend such people, listen to them. Note that every successful trader or investor has had a role model or a mentor, and if you find one, you will significantly increase your chances of succeeding in the trading world. On the other hand, disregarding feedback from the market or other traders can lead to repeated mistakes.

Solution: Be open to feedback and constructive criticism. Engage with trading communities and mentors who can provide valuable insights and advice.

Ready to Become a Funded Trader?

Transitioning from a demo to a funded account is a significant step in a trader’s journey. It requires not only technical skills but also psychological resilience and strategic planning. By ensuring a gradual transition, understanding the psychological shift, having a trading plan, and sticking to it, traders can navigate this process smoothly. Ultimately, the key to mastering the transition lies in preparation, discipline, and a willingness to adapt. Focus on these, and we will soon be writing about you as part of our success stories. The first step to embarking on this journey is enrolling in Earn2Trade’s Trader Career Path® program.