Last Updated on December 1, 2022

An Israeli-American businessman, Adam Neumann is an entrepreneur and real estate investor. Alongside Miguel McKelvey, he cofounded WeWork in 2010 and worked as a CEO until 2019.

In 2019, he stepped down, stating that he was becoming “a distraction” in the face of WeWork’s IPO plans. However, he started another venture with his wife, Rebekah Newmann, called 166 2nd Financial Services.

He sold his shares internally in WeWork before it went public for over $1 billion. He acquired over $1 billion worth of real estate assets in apartment buildings before debt.

As of April 12, 2024, Forbes approximates Neumann’s net worth at $2.3 billion, making him the 1461st richest person in the world.

Adam Neumann’s Life Story

Adam Neumann is 43 years old. He was born in 1979 in Tel Aviv, Israel. His parents divorced when he was only seven years old. By the age of 22, he had already lived with his mother in over 13 different homes.

For some time, Adam lived in a kibbutz – settlements in Israel that host a collective community. His mother was a doctor employed at a hospital near the Gaza Strip.

Neuman, however, had severe dyslexia and couldn’t write or read until the third grade.

He served with the Israel Defense Force (IDF), as do all Israeli citizens. However, he stayed there for over five years instead of the mandatory three years required by the law.

In 2001, he moved to New York City to live with his sister Adi Neumann – a model.

A year later, in 2002, Neumann enrolled at Baruch College as a business major. During college, he came up with the idea for WeWork and WeLive.

WeWork is a coworking space provider with the mission to bring individuals and companies together under one roof to improve collaboration and help accelerate development. Be it a freelancer or a Fortune 500, WeWork offers space for everyone because – in their words – “that’s how tomorrow works.”

Founding WeWork

Neumann started WeWork with a single location in New York City in 2010. However, since its inception, the company has gone global, operating in 77 cities across 23 countries.

WeLive was supposed to be a subsidiary of WeWork for a communal living space. He presented his idea to an entrepreneurship contest, but a judge scrapped it, claiming that he wouldn’t be able to raise the needed capital.

Neumann dropped out of college when he only needed four more credits to earn a degree. He didn’t come back to complete his education for 15 years. In 2017, he got his four credits and completed his degree while also giving the commencement address at Baruch College’s graduation ceremony.

During his time in college, Neumann met Rebekah Paltrow – his future wife. She is actress Gwyneth Paltrow’s cousin. They married in 2009 and have five children.

Neumann credits Rebekah for helping him quit smoking and reach for his passions instead of just mindlessly trying to make money.

Rebekah is also one of the founding partners of WeWork. She used the umbrella “We” to start a subsidiary called WeGrow – an elementary school operated in New York City until 2019.

Adam Neumann’s Career

Neumann is known for his company, WeWork, and his massive real estate investments. However, before that, Neumann was involved in several different business ventures.

During his time at college, Neumann worked on two other business ideas besides WeWork.

The first was the concept for a retractable heel shoe. While it may seem quite innovative, the idea failed.

The other concept was for a line of baby clothes with knee pads built into the clothing to prevent babies from getting injured. Neumann called these clothes Krawlers. This idea was successful, and Neumann quit college to focus on it.

Krawlers became a full-fledged clothing brand called Egg Baby by 2006. Egg Baby is a luxury baby clothing brand run by the renowned designer Suzan Lazar. They sell their clothes around the world at various departmental stores. However, Neumann doesn’t really look after the everyday operations of Egg Baby any longer.

Soon after, Neumann met his future colleague and cofounder of WeWork, Miguel McKelvey. McKelvey and Neumann bonded quickly over the many similarities in their background. Soon, Miguel invited Adam to start running Egg Baby’s office operations.

Then they launched Green Desk – an eco-friendly coworking space. However, Neumann and McKelvey saw the potential in their idea for more growth and decided to sell Green Desk to their landlord for $3 million, according to Forbes.

With an investment of $15 million by Joel Schreiber (in exchange for a 33% share in the company), the two founded WeWork in 2010.

With Neumann running the operations as the CEO, WeWork saw rapid growth. At its peak, the company operated in over 120 cities in 40 different countries and was valued at $47 billion, according to Finty.

Adam Neumann’s net worth

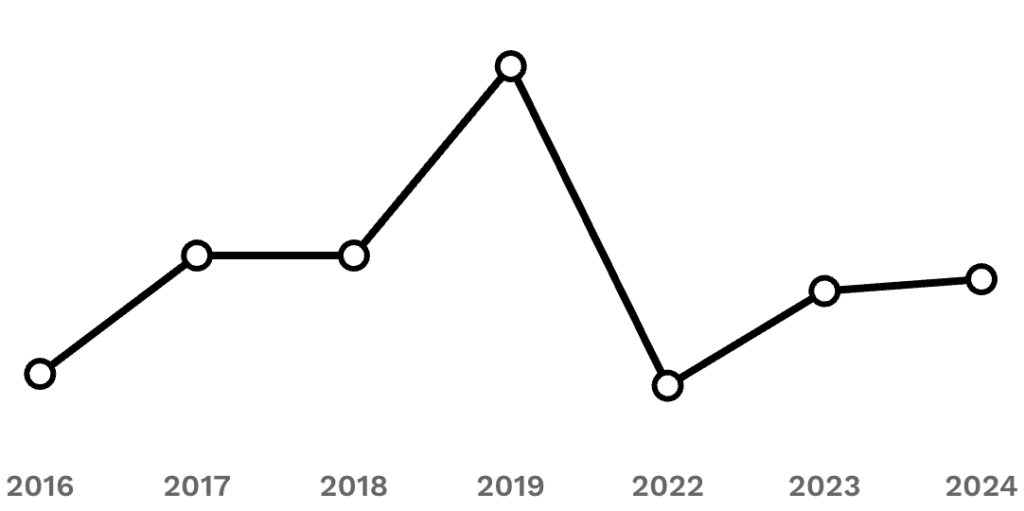

Neumann was estimated to have a net worth of over $4 billion at his peak. However, after several controversies, he is currently worth around $2.3 billion, according to Forbes.

While Neumann was WeWork’s biggest shareholder, he cashed out some of the shares. He also took several loans. In total, it was all estimated at around $700 million.

When WeWork decided to go public with an IPO, their losses came to light. In 2019, WeWork suffered a loss of $1.6 billion in 2018, while their revenue for the fiscal year was only $1.8 billion, according to Business Insider.

However, with the increased scrutiny of WeWork’s transactions, it was discovered that Neumann had been paid around $6 million to be bought out of the “We” trademark. But due to the widespread backlash, Neumann had to return the money.

The IPO also revealed that Neumann’s shares gave him special privileges at WeWork. He was given 20 votes for every share he held, giving him majority control. All of this led to a major backlash, and WeWork had to postpone its IPO.

Since most of the backslash stemmed from the acts of Neumann, the board decided to cut down his control over the company.

Later that year, in September 2019, an updated IPO was issued by WeWork, where Neumann’s influence over the company’s matters had been significantly reduced by the board. By that time, WeWork’s value had dropped to $20 billion – less than half its initial $47 billion valuation.

Neumann faced further criticism when a report by the Wall Street Journal shed light on his lifestyle, including drug and alcohol use. Moreover, he is also said to have once chartered a private Gulfstream G650 to go to Israel with his friends. However, the jet was called back by its owner when marijuana was discovered on board, hidden away in a cereal box.

Due to the criticism, the board at WeWork decided to remove Neumann – a decision backed by Neuman’s friend and WeWork’s biggest investor, the head of SoftBank Masayoshi “Yoda” Son.

After Neumann stepped down, WeWork postponed the IPO. The firing by the board made Neumann sell at least two properties that we know of. These were a New York City penthouse and a house in the Hamptons. The latter was sold for over $1.25 million in March 2020.

Before he stepped down, Neumann was temporarily allowed to serve as the chairman of the board of directors at WeWork. However, the company’s control was handed over to SoftBank, the largest investor in WeWork.

This deal was a $9.5 billion buyout plan that gave Neumann $1.7 billion. But it never went through. Instead, SoftBank bought $3 billion worth of shares of WeWork, of which $970 million came from Neumann.

Adam Neumann’s Trading Strategy

Since the formation of WeWork, Neumann has invested over $80 million in five real estate properties. Two are in New York City, and one is a home in the Hamptons.

In 2018, Neumann purchased a 13,000 sq. feet home with a guitar-shaped room. This new property was priced at $21 million in the San Francisco Bay Area, as per the Wall Street Journal.

Aside from that, Neumann used his personal capital and WeWork’s portfolio to invest in several startups. One of his investments was a wave maker for swimming pools. Another investment was in medical marijuana and superfood start-up. It sold a variety of items, including things like “performance mushrooms” and a high-concentration caffeine coffee.

After WeWork, Neumann got back into the investing game. He started a new housing company called Flow. Flow has been backed by Andreessen “A16z” Horowitz with a whopping $350 million.

Currently, Flow has a valuation of $1 billion. Neumann has reportedly purchased around 3,000 housing units, valued cumulatively at $1 billion.

While Flow’s business model is not exactly clear yet, it seems that the startup wants to solve the diminishing housing supply in the US by offering community living.

A16z has also backed another venture of Neumann’s, the FlowCarbon. It is a cryptocurrency startup that tokenizes carbon credits for developers working in the renewable energy sector.

FlowCarbon managed to raise around $32 million but has been paused indefinitely.

Conclusion

Adam Neumann had quite a busy life. From constantly moving around in his childhood to working in the IDF, his early life sure wasn’t easy. However, Neumann didn’t let that stop him from amassing a $4 billion fortune.

Despite his success, Neumann made some terrible decisions, and when they started coming to light with WeWork’s IPO plans, Neumann’s net worth started to decline.